ASPIRE BUSINESS MANAGEMENT SOFTWARE

Accurate financial data with cost accounting in Aspire

The Aspire platform streamlines financial workflows by centralizing cost accounting and can provide standardized export files for seamless payroll integration.

![Product Screenshot | Accounting [Weekly Time Review] Product Screenshot | Accounting [Weekly Time Review]](http://images.ctfassets.net/3cnw7q4l5405/4rO9313BVcYG6S30qQywQk/92d403315652af9167b2c062d4d7c883/Acct___Payroll_02.3__1_.webp)

Maintain clean, accurate data for your financials and payroll processing.

Avoid syncing errors and inaccuracies in your financials and your payroll export files with the Aspire platform's accounting and payroll integrations.

Trustworthy financials.

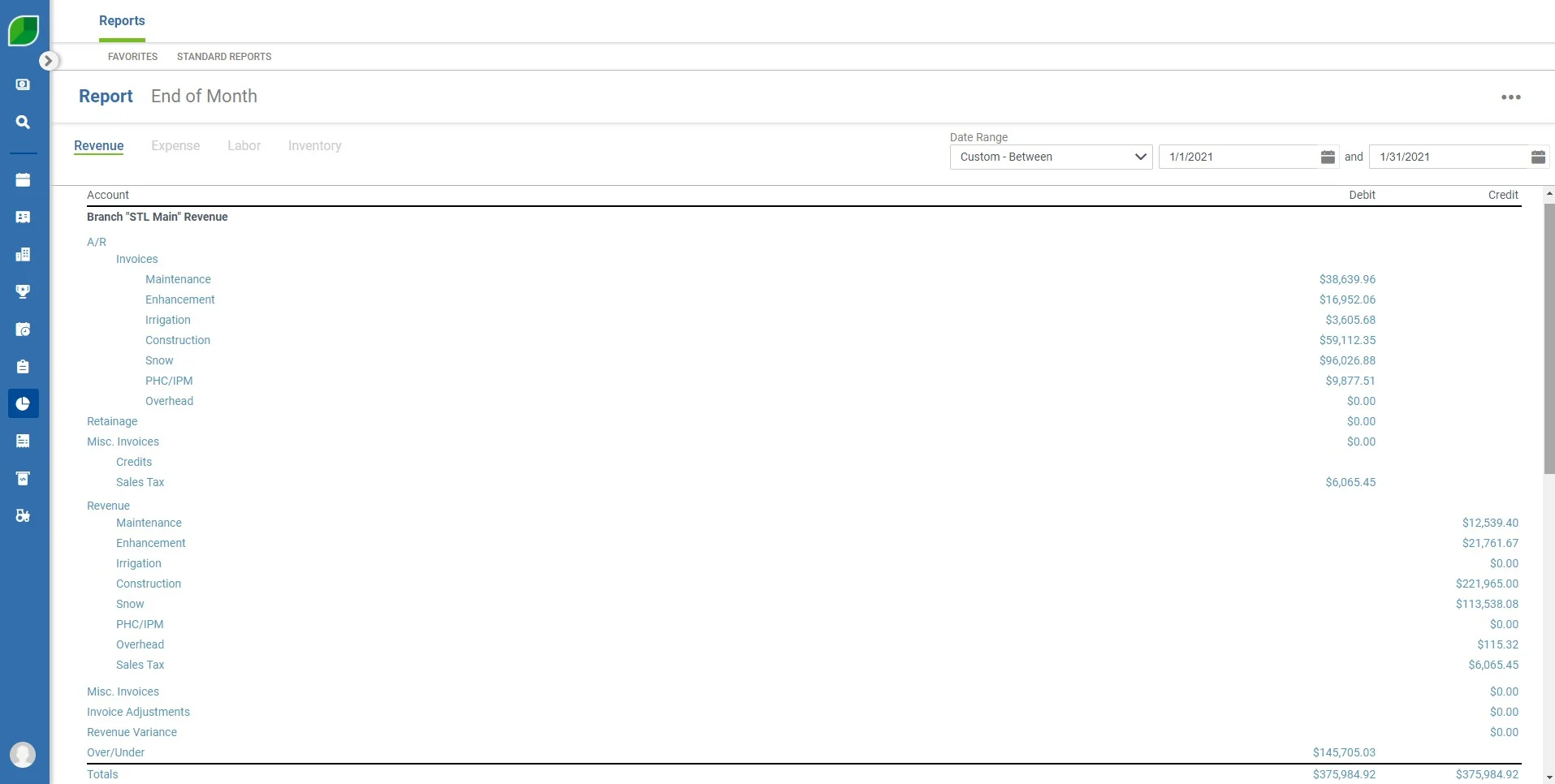

Say farewell to the days of dealing with data that doesn’t match up. The Aspire platform houses all your business data (above the gross-margin line) while your accounting system handles everything related to your indirect costs.

Aspire pushes limited data – vendor invoice information, AR deposits – and provides end-of-month P&L data for every division to record in your accounting system and ensure your financials stay accurate. With confidence in your financial data, you’ll be empowered to make timely decisions that have the greatest impact on your business.

Simplified payroll.

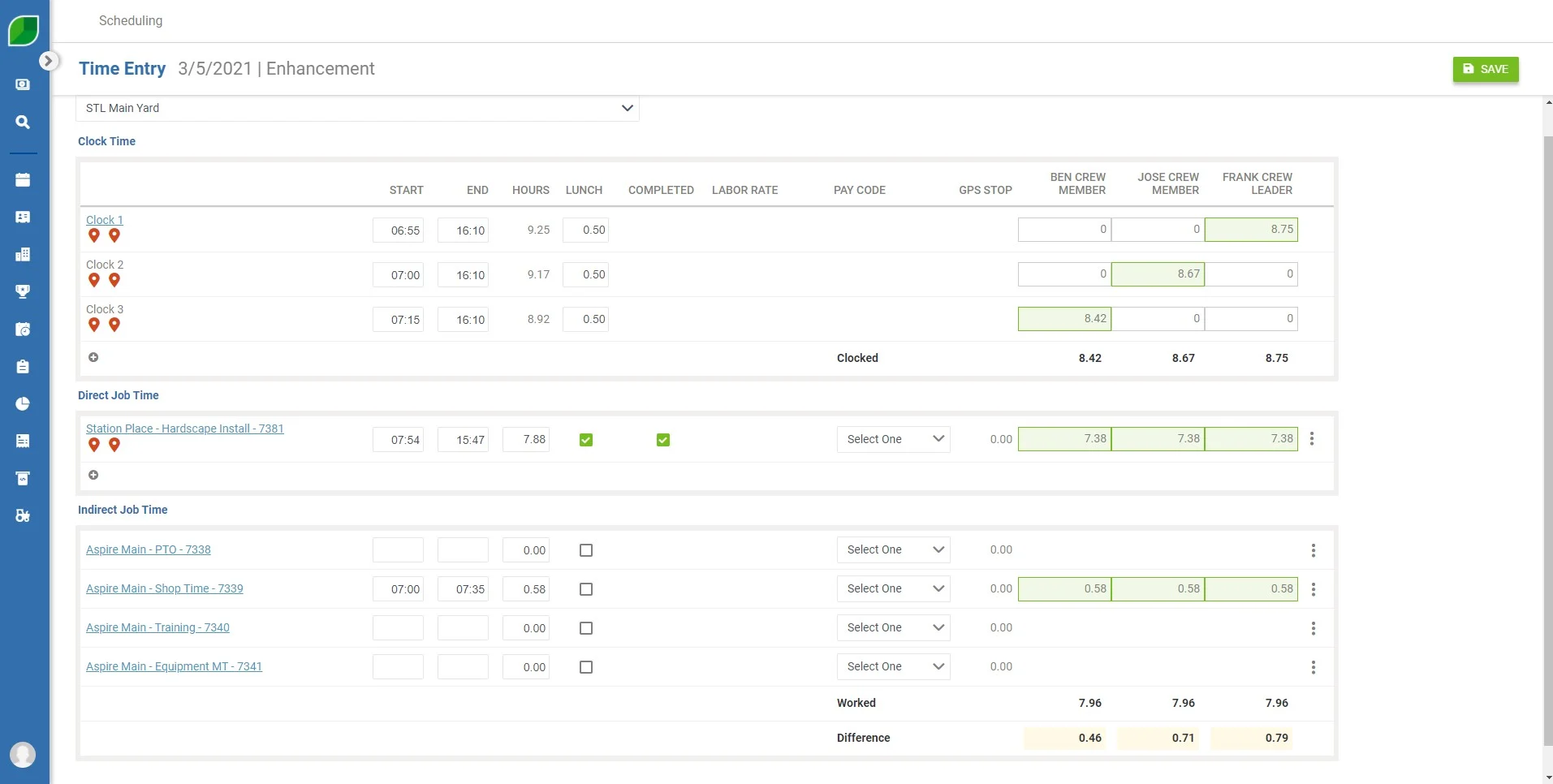

On the timekeeping and payroll front, Aspire helps ensure accuracy in several ways. While the system is tracking accurate job costs for your team by applying all labor performed each day to every job, it’s also using that data to create the payroll file you export at the end of each week.

As your techs, teams, or crews perform work in the field, the Aspire platform's Crew Mobile app enables quick and simple time reporting from any mobile device. With the app, managers can easily review mobile time data each day and make any necessary adjustments before daily approval of hours and material. After your payroll manager reviews time entries throughout the week and at week’s end, your payroll file is correct and ready to export and import into your payroll system with minimal, if any, modifications. Aspire clients who opt to use Inova for their payroll needs can simply sync their data to Inova's payroll management platform.

Standardized processes.

The Aspire platform was developed specifically to help businesses continue to grow with consistently higher profitability. With that goal in mind, the system was designed with defined workflows in place that reinforce processes based on industry best practices.

The end result? Improved efficiency that allows users across your entire organization to focus on activities that make the greatest impact. Already have processes in place that work for you? No worries—Aspire's unique configurability and flexibility enables the system to accommodate your business’s specific needs.

Even better, since Aspire provides the end-to-end functionality you need to run your business, your teams can focus on utilizing one software package—and learn how to use it to its fullest—versus struggling to master multiple solutions incapable of connecting data and informing business decisions.

GET STARTED

Find the solution that's right for you

Aspire is here to help you achieve your goals. Tell us what you’re looking for and we'll match you with a solution that meets your needs.

Book a demo

Download Now

Book a demo

FrontRunner & Category Leader 2025

How are pricing and margins managed in Aspire?

Pricing and margins are managed using the multiple overhead recovery system. Aspire uses markup to recover overhead and margins to generate the final price while providing flexibility at the branch, division, service, and customer levels. This approach provides complete granularity and reporting to assess profitability.

Do you provide built-in job costing?

Aspire is your job costing system for maintenance, enhancement or tag-on, construction or ancillary, snow/ice removal, and T&M work. The system manages all your job costs in real-time.

How does Aspire handle different pricing for different customers?

Aspire uses templates to establish contract pricing. There is no limit to the number of templates; therefore, the kind and type of pricing is based on branch, customer, etc.

How do costs/expenses get recorded to jobs in Aspire?

Purchase Receipts – the PR is processed in Aspire for items that were purchased directly for the job.

Inventory – items can be purchased into inventory and allocated to the job.

Hours clocked to the job.

Does Aspire manage inventory?

Aspire has inventory functionality that is linked to the purchasing module. You can set up costs for your inventory items to allow you to see your estimated vs. actuals for job costing. In addition, Aspire maintains inventory-transaction history as well as a standard-cost function for inventory valuation.

Are expenses handled in Aspire or our accounting system?

All job-related expenses are managed in Aspire. All other expenses below the gross-profit line are managed in your accounting system to eliminate any duplication of data and unnecessary migration of information between the two platforms.

What information flows to the accounting system and how?

There are 4 primary data points between Aspire and your accounting/payroll system:

Deposits sync to your accounting system

Purchase Receipts sync to your accounting system

We are integrated with QuickBooks Desktop and Inova or we have Payroll export files which are used to process payroll

Revenue and expenses/cost of goods sold data are provided to record in your accounting system.

Does Aspire use General Ledger Account numbers?

Yes, Aspire will provide data linked to your general ledger account numbers. The system manages and tracks earned revenue/work in progress, invoiced revenue– all in real time. This information is provided to record revenue and expenses accurately in your accounting system.

Can you have different general ledger account numbers assigned to different locations?

Aspire supports separate branch accounting as well as individual company accounting files.

Is budgeting handled within Aspire or in your accounting system?

Aspire has a rolling budget management tool. Aspire clients typically build their budgets in their accounting system or in a spreadsheet to input the data into the rolling budgets.

Is there a built-in accounting package?

Aspire integrates with multiple accounting systems where your general ledger is managed, so you can use Aspire as your cost accounting system and easily code revenue and cost of goods sold directly to your general ledger.

What accounting integrations does Aspire offer?

Aspire currently offers accounting integrations with QuickBooks and Acumatica as well as API integration options to allow our enterprise-tier clients to build a connection to other accounting systems.

What payroll integrations does Aspire offer?

For payroll, we recommend Inova, our integration partner and preferred payroll provider; however, you can export payroll data from Aspire for submission to other payroll processors. We also have integrations with QuickBooks Desktop and custom API through our open restful API for payroll.

Products

©2025 Aspire Software. All rights reserved.