Table of Contents

Table of Contents

- What are the most common tax challenges landscaping businesses face?

- What landscaping expenses can be deducted to lower tax liability?

- How can landscaping businesses improve record-keeping for tax season?

- Keep digital records and receipts

- Use accounting or business management software

- Track income and expenses on a regular schedule

- Maintain separate business and personal bank accounts

- Use mileage and time tracking apps for accurate reporting

- Should you file quarterly estimated taxes?

- How to choose the right business structure for tax savings

- Sole proprietorship

- Limited Liability Company (LLC)

- Corporations

- How can landscaping businesses avoid red flags that trigger IRS audits?

- How Aspire helps landscaping businesses simplify tax season

- How Aspire helps landscaping businesses simplify tax season

Here’s the thing about managing taxes—no one likes it (except maybe CPAs). But every landscaping business, whether self-owned or a partnership, must file taxes.

Even when businesses are busy growing their customer base and delivering exceptional service, they still have to try and unpack Section 199A aggregation rules for their multiple LLCs as well, or deal with employee vs. contractor payroll tax.

Not only is it challenging to keep up, but failing to comply with tax regulations can lead to missed deductions and penalties.

It’s a lot, but here’s the upside: the right landscaping-specific tax information can help you manage taxes effectively and reduce the amount you pay. And that’s what you’ll find in this post.

This guide will provide actionable tips to help landscaping businesses:

Maximize deductions specific to the landscaping industry.

Stay compliant with record-keeping during tax season.

Streamline time-consuming manual tax preparation.

What are the most common tax challenges landscaping businesses face?

Poor record-keeping and complex tax rules are just some of the tax challenges landscaping businesses have to deal with.

You’ll likely also have to face issues such as:

Worker misclassification: When you hire seasonal workers for the busy months, deciding whether to categorize them as workers or contractors can be challenging. Especially because some of them bring their own tools and set their own schedules, while others don’t.

The IRS says that if an employer can control where, how, and when its people work, they are employees, not independent contractors.

But how does that apply to landscaping crews that work for a season? That can be challenging, and if you misclassify employees, you’ll owe back payroll taxes and possible penalties.

Difficulty tracking expenses and revenue: One common challenge is organizing receipts, mileage reports, and expense reports in a single location. The records are typically scattered with cash payments from homeowners, receipts in the vehicle’s glove compartment, and personal and business expenses mixed up on the same card. When it’s tax season, it becomes challenging to reconstruct all your transactions and file accurate taxes.

Changing regulations: Constant changes in federal and state tax laws make it difficult to manage taxes efficiently. For instance, the tax rules for landscaping equipment, used or new, are different. There are three types of depreciation: bonus depreciation, regular depreciation, and Section 179. This makes it challenging to know which method saves you the most money.

Multi-state compliance: Landscaping businesses with a presence across different state lines face complex tax rules, as each state has its own specific tax requirements.

While some demand taxes on materials, others don’t. As such, it’s difficult to know what you owe where.

Multiple entity management: You own several landscaping companies for liability protection and have to file tax returns for each business separately, with the Section 199A deduction calculated independently.

You’ve heard about aggregation, but don’t know what it means or how it helps the business. This leaves you with lower deductions than you might have had.

All these challenges might seem overwhelming, but you can take control, maximize those tax deductions, and save money. That’s why you’ve been keeping receipts, after all. But you need to know which expenses make the magic happen.

The following section clears that up.

What landscaping expenses can be deducted to lower tax liability?

One way to effectively plan for taxes is to know what exactly can be deducted. As a landscaping business owner, you have access to different deductible expenses that could save you thousands of dollars when claimed.

The table below shows several tax deductions you can take advantage of.

The table shows that effective reporting is crucial for tax deductions. Next, you’ll find tips on how to keep proper records for tax season.

How can landscaping businesses improve record-keeping for tax season?

There are several opportunities to save on your tax bills, but most are centered on detailed record-keeping. Without proper documentation, you’ll be unable to prove claims of business expenses, potentially costing you thousands in lost deductions.

That’s why you’ll learn different ways to keep landscaping business records organized and tax-ready in this section.

Keep digital records and receipts

Paper receipts are common among many landscaping businesses. But while that’s a good thing—providing immediate proof of purchase or physical backup—paper receipts easily fade, get lost, or become damaged.

This makes it challenging to track finances and prepare documents during tax season.

A better alternative is to keep digital records for easy monitoring, reporting, audit defense, deduction tracking, and documentation.

Here are practical ways you can do that:

Opt for email receipts where possible from vendors.

Use expense tracking software such as QuickBooks or Zoho Expense to snap pictures of paper receipts. This ensures data is extracted and stored digitally.

Use a dedicated business debit or credit card to log transactions and match them with receipts automatically.

Create a shared cloud folder for storing receipts by expense type.

Review expenses and receipts on a weekly basis to avoid last-minute scrambling.

Use accounting or business management software

If you’ve always used spreadsheets and other manual methods to track finances, it’s time to switch to more professional accounting management software.

Tools like this help centralize your financial data in a single location, saving time and ensuring accurate records during tax season.

Instead of manually writing formulas susceptible to error or inputting data for each transaction, consuming time, these processes become automated.

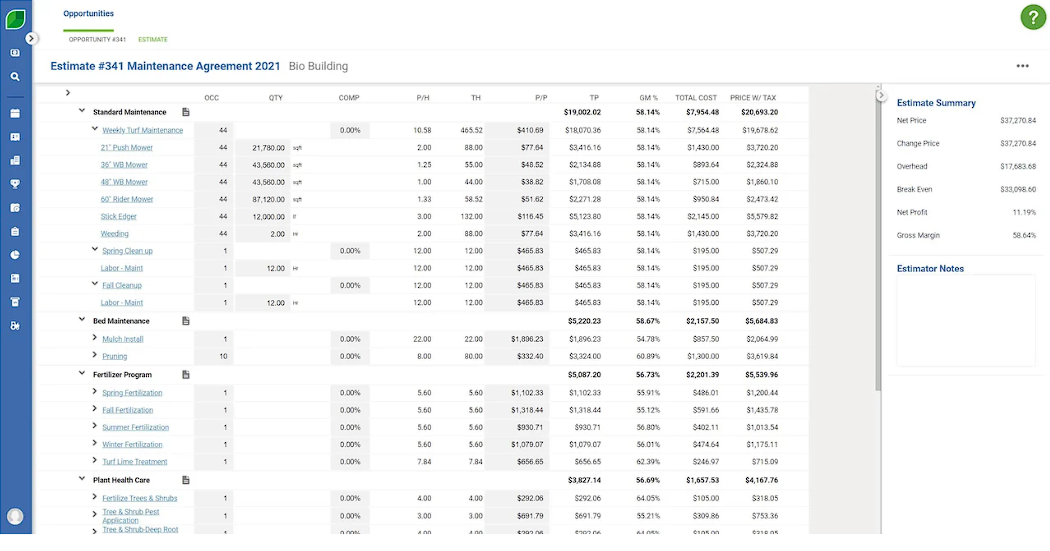

In fact, software like Aspire offers accounting, job costing, estimating, and reporting tools to streamline your workflow and help avoid inconsistencies in your finances.

Aspire also integrates with other accounting tools like QuickBooks, making it easy to sync job costs and business-related payments. This reduces manual data entry between multiple platforms, keeps your books clean, and ensures a smooth end-to-end financial workflow.

Track income and expenses on a regular schedule

Want to ensure your landscaping business is always audit or tax-ready?

Constantly monitor the company’s finances. Don’t wait till the end of a quarter or the year before checking the books. That’s last-minute planning that could lead to errors or even penalties.

Create a system for keeping records (digitally), and set a weekly, bi-weekly, or monthly review of the business finances—invoices, expenses, debt, and cash flow.

A recurring reminder of this task, in partnership with an accountant or CPA, would make tracking consistent.

This will ensure:

You’re less likely to forget payments, misreport amounts, or make mistakes that could lead to IRS penalties or missed deductions.

You have a clear picture of your finances and are ready for tax payments.

Tax filing is faster and smoother since records are already in order.

You’re able to justify deductions if the IRS ever asks.

Maintain separate business and personal bank accounts

Mixing personal and business finances can complicate record-keeping and tax filing. You need to avoid that as it can raise several alarms during tax season and probably lead to IRS penalties.

By maintaining separate accounts, here’s what you get:

Simplified tax categorization so you can identify business income and expenses, making it easy to prepare accurate tax returns.

Ability to spot valid business deductions. This ensures you don’t miss out on crucial write-offs.

An audit-ready business. You’ll always have clear records without confusing transactions. This way, you’re always ready for an audit.

Simplified bookkeeping. Tracking financial transactions and generating reports will be much easier with separate accounts. You won’t have to worry about mixing up data; everything in the records will be solely business transactions.

Use mileage and time tracking apps for accurate reporting

Mileage logs are crucial for vehicle tax deductions, and the hours the landscaping crew spends on a job, for employee wages.

Keeping records like these isn’t as direct as calculating utilities or supplies. You need to have been tracking mileage and hours worked to get them accurate.

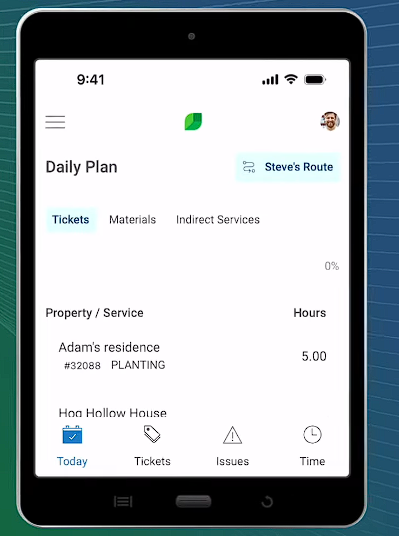

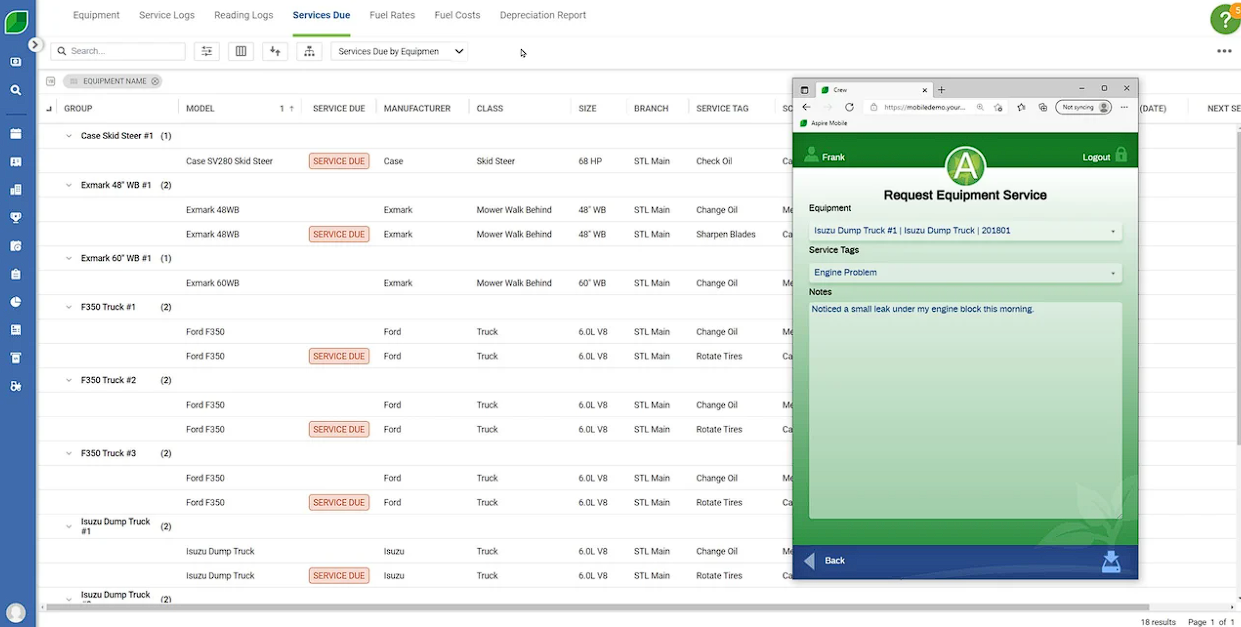

To do that, you need digital tools like the Aspire Mobile app that support employee time tracking. Crew members can clock in and out using their mobile devices, making tracking hours spent and calculating their wages easy.

Aspire also integrates with Azuga for vehicle GPS and mileage tracking. You can set it up to monitor mileage and operations data at all times.

With such apps in place, you can access data for accurate reporting come tax season.

Should you file quarterly estimated taxes?

Definitely, especially if your landscaping business is classified as self-employed, a partnership, or a sole proprietorship.

Unlike traditional landscaping employees who have taxes automatically withheld, you’re responsible for paying yours. That’s why the IRS recommends a pay-as-you-go approach to avoid large surprise tax bills at year's end and potential penalties.

These quarterly payments are typically due on:

April 15

June 15

September 15

January 15 (of the following year)

If you miss any of these quarterly payments, the IRS charges fines of 0.5% of the unpaid amount per month and up to 25% of the total unpaid taxes.

The tax payments are calculated based on the estimated gross income for the coming year. It can be the entire amount you expect to make for the year or a specific figure for each quarter.

But considering the seasonality of landscaping businesses, you can use the previous year’s gross income as a guide. From there:

Subtract any eligible deductions to get the adjusted gross income.

Calculate the total expected tax liability (this includes income tax and self-employment tax).

Divide that amount by four to determine your quarterly payments.

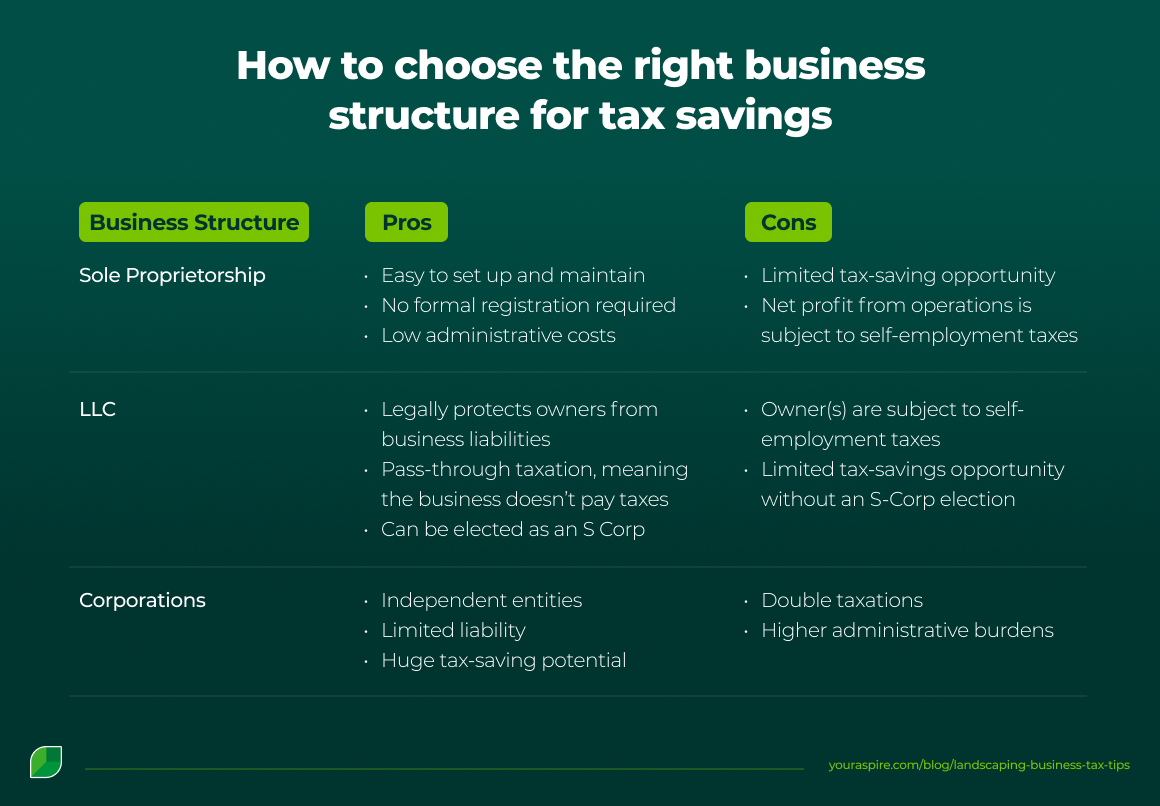

How to choose the right business structure for tax savings

Do you know that choosing a business structure isn’t just a legal decision? It directly impacts how much tax your business will pay.

Each structure—sole proprietorship, LLC, and S Corps—has its tax rules and paperwork requirements, so it’s essential to learn how each affects your tax obligations.

Below, you’ll see how they stack up and affect your taxes.

Sole proprietorship

This is a pretty common business structure for most solo landscaping business owners, as it’s easy to set up and manage. Here, you and the business are legally the same. No formal registration is needed aside from local licenses or permits.

In a sole proprietorship structure, business income is reported on your personal tax returns. You’ll pay income and self-employment taxes (about 15.3%) on profits.

Here’s how you can save on taxes with this structure:

Claim business deductions where possible (equipment purchase, maintenance, etc.)

Low administrative costs, which means no payroll costs or corporate filing fees.

However, you can’t split income between salary and distribution to reduce self-employment taxes as with other structures. All profits are taxed at the full self-employment tax rates:

15.3% for net earnings

12.4% for social security

2.9% for Medicare

Limited Liability Company (LLC)

This business structure keeps the company as a legal entity separate from your personal assets, offering liability protection. It can be owned by one person or a group of individuals.

For single-member LLCs, the business is taxed by default like a sole proprietorship, and multi-member LLCs are taxed like a partnership.

There are a few ways to save on tax here:

Claim deductions on business expenses to reduce taxable income.

Leverage pass-through taxation, where the business doesn’t pay income taxes. Instead, profits are taxed on your personal return.

The game-changer is if you elect the LLC to be taxed as an S corporation. This changes how profits are handled, opening more opportunities for tax savings.

It allows you to split income into salary and distributions. But in this case, only the salary is subject to payroll taxes, potentially saving you thousands in taxes. However, electing too early can increase costs and compliance burdens without reasonable benefits.

Corporations

Also known as C Corporations, this business structure operates as a separate legal and tax entity. It provides the strongest liability protection and is typically used by large businesses seeking outside investors.

Since it’s a single entity, corporate taxes (21%) are directly deducted from its profits. However, if you take dividends from the business’s profits, you’ll pay personal income tax on the amount. In other words, double taxation.

For most landscaping businesses, this double taxation and added administrative burden make it less practical than an LLC.

But there are ways to save on taxes with a C Corp, such as:

Deductions of fringe benefits for employees and owners as business expenses.

Electing the S-Corp tax treatment, where income is split into salary (taxable) and distribution (not taxable).

How can landscaping businesses avoid red flags that trigger IRS audits?

You’ve seen different ways to save on taxes. But as you take advantage of deductions, it’s equally important to stay off the IRS’s radar and reduce your chances of an audit.

In this section, you’ll learn the various red flags that could trigger an audit and how your landscaping business can avoid them:

Worker misclassification: Failure to classify workers as employees or independent contractors is common in landscaping. And understandably so because of seasonality. However, the IRS closely monitors such relationships, especially if the worker lacks the proper business license or your company controls how, when, and where work is done. Wrong classification could lead to fines or paying additional tax at a later date.

How to avoid it: Ensure you review IRS worker classification guidelines, maintain documentation that supports the classification, and issue 1099 forms to independent contractors.

Poor documentation: If you receive large amounts of cash and fail to report them correctly, your landscaping business may become suspicious to the IRS. Perhaps the reported income seems too low compared to industry standards, making the IRS suspect underreporting.

How to avoid it:

Use proper management software, like Aspire, to track the business’s finances.

Deposit cash into the bank for seamless monitoring

Use and keep invoices, receipts, and bank statements.

Large or unusual deductions: When deductions are too large for the size of your business, it can draw scrutiny from the IRS. This can happen when you claim overly high business expenses or full business use for trucks or tools that are also used personally.

How to avoid it: Keep detailed records (vehicle mileage logs, receipts, etc.) for each deduction. Ensure you only deduct necessary business expenses.

Operating multiple entities without clear separation: The IRS may come knocking if you run various LLCs or DBAs for different landscaping services with payroll cross-overs you can’t track. Since they’re separate entities that need to pay taxes, the mix-up might make it challenging to know which one is owing.

How to avoid it:

Keep separate accounts and books for each company.

Aggregate the businesses for tax purposes.

How Aspire helps landscaping businesses simplify tax season

Want to know the main way to avoid audits and ensure your landscaping business is always ready come tax season?

Keep accurate, consistent records. Aspire helps with that by providing tools that streamline your financial operations and keep everything in one place.

Here’s a peek into some of these tools:

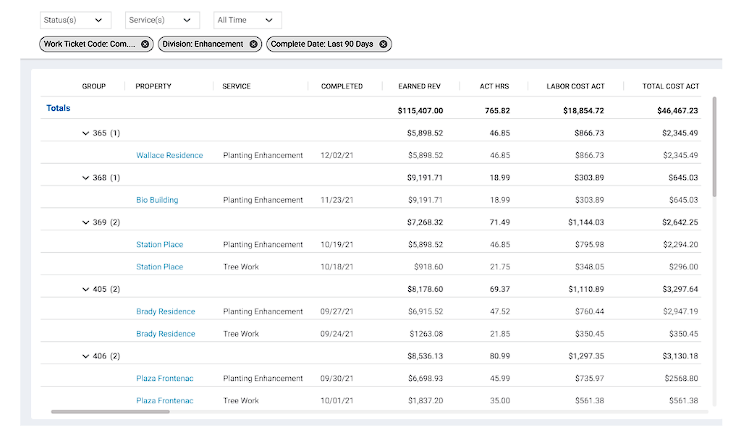

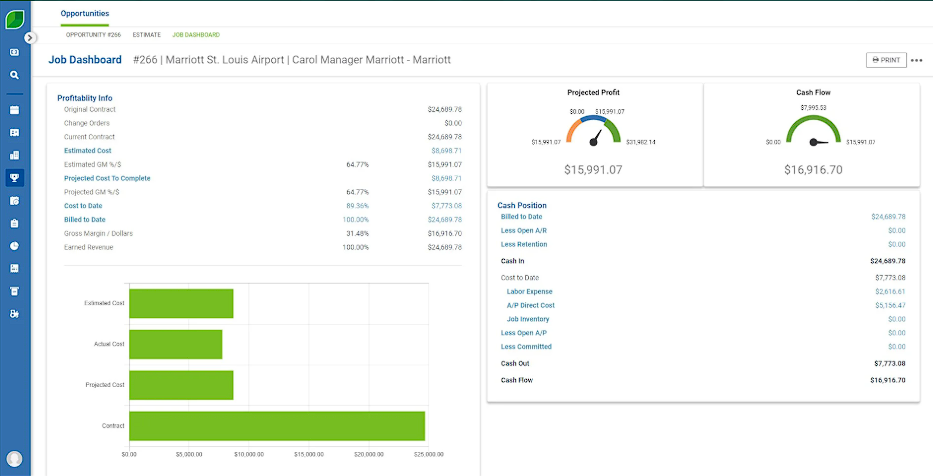

Financial tracking: Having all your financial data in one place makes it easier to track during tax filing. With Aspire, you have access to estimates, job costs, invoices, payments, expenses, and more in a single location.

It helps you see outstanding invoices, monitor payroll, and track wages, work hours, and tax deductions. That means you’re equipped with complete financial insights into business operations, ensuring you’re ready for compliance and smarter decisions.

Equipment management: Understand how your vehicles and landscaping equipment are performing. How many miles has the truck covered? When was the last maintenance? Is your heavy equipment still functioning or deteriorating?

Which one is due for a change or maintenance? Aspire’s equipment-management feature, with its tracking and reporting capabilities, helps you answer these questions.

Detailed reporting: Aspire enables you to generate financial reports, such as profit and loss, cash flow, and balance sheets, with a single click. These allow you to track expenses and profitability, delivering valuable insights into your business’s finances for better tax reporting and decision-making.

Its reporting feature has customizable dashboards that give every team member visibility into real-time metrics. This ensures you have access to key financial details come tax season and can track profitability and plan for long-term growth.

Aspire is also integrated with accounting tools like QuickBooks, reducing manual entry and ensuring error-free finances.

With a centralized system, Aspire helps you store every detail of your landscaping operations so nothing slips through the cracks when filing taxes.

Take a deep dive into Aspire’s complete offering and how it works—book a demo today.

![Landscaping Business Due Diligence: Complete Guide [2025] Landscaping Business Due Diligence: Complete Guide [2025]](http://images.ctfassets.net/3cnw7q4l5405/6FhiPCf8mCcAawEddWnUXm/69ff3b97b13c1f0ca6f6d956adc2dd07/Landscaping_business_due_diligence__complete__guide_-2025-.png)

![How to Hire a Bookkeeper for Landscapers: Full Guide [2026] How to Hire a Bookkeeper for Landscapers: Full Guide [2026]](http://images.ctfassets.net/3cnw7q4l5405/5AbVDtokUcXVBR3HYotDM8/dcafa256d702a0e2a4fa432e9de43fb7/How_to_hire_a_bookkeeper_for_landscapers.png)